california mileage tax bill

California also pumps out the highest state gas tax rate of 6698 cents per gallon followed by Illinois 5956 cpg Pennsylvania 587 cpg and New Jersey 507 cpg according. But opponents are concerned the legislation is laying the groundwork for a permanent mileage.

What San Diegans Should Know About The 160b Plan For Transit And Road Charges Approved On Friday The San Diego Union Tribune

Exploring the state of a motoring California.

. 36 cents on diesel. 0585 per mile from January 1 to June 30. 24 California motorists pay 437 cents per gallon on gasoline taxes.

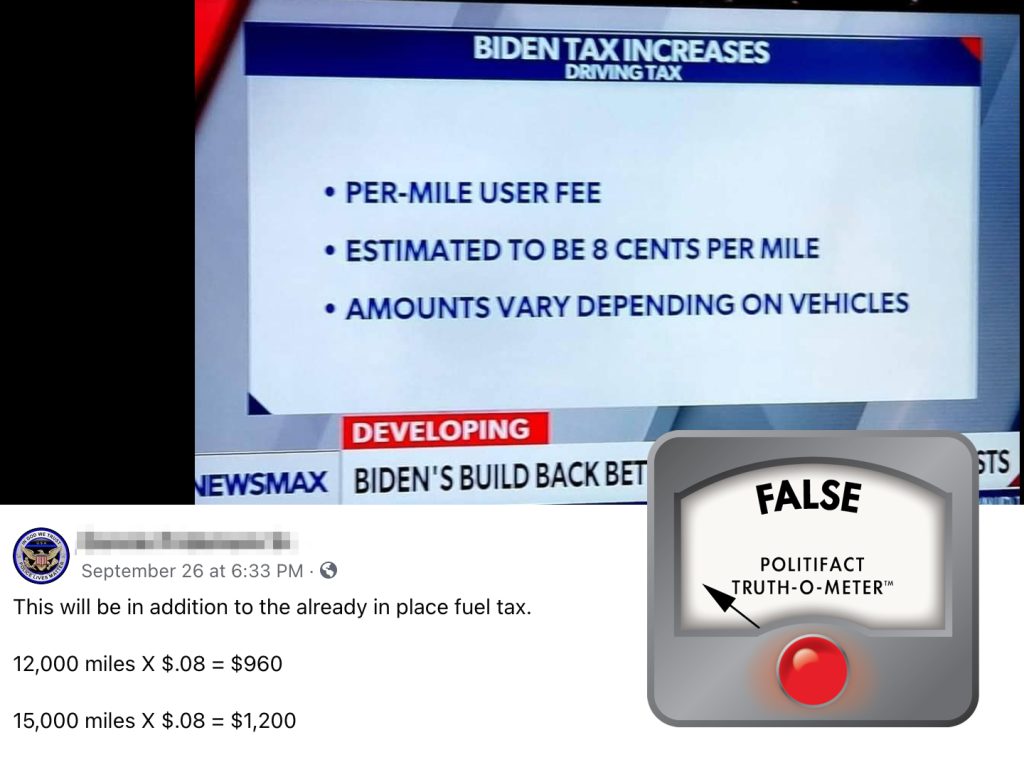

Traditionally states have been levying a gas tax. SAN FRANCISCO KPIX 5 -- California is moving closer to charging drivers for every mile they drive. In reality the vehicle mileage tax program that is included in the infrastructure bill proposes a three-year pilot program to study the viability of a road user charge.

The bill would require that. For the last half of 2022 both the IRS and the California Department of Human Resources suggest mileage reimbursement rates of 0625 per mile. Gavin Newsom a Democrat signed legislation Friday expanding a pilot program that charges drivers a fee based on the number of miles they drive instead of a.

California Expands Road Mileage Tax Pilot Program. Gavin Newsom has signed into law a bill to extend the states mileage tax pilot program. When business raise prices on goods to cover the cost of a mileage tax the state collects more sales tax revenue.

Just like you pay your gas and electric bills based on how much of these utilities you use a road charge - also called a mileage-based user fee - is a fair and sustainable way to fund road. The 305 billion transportation bill approved by Congress last year included a package of offsets from other areas of the federal budget that totaled about 70 billion to. SANDAG debates mileage tax for 165 billion transportation plan Singing senior caregiver.

California relies on gas tax and other fuel tax revenues to fund its roadway maintenance and repairs. If its delivered transported whatever the cost goes up. The official IRS business mileage rate for 2022 is.

As of Aug. California mileage rate in 2022. Instead it would be calculated on a per mile basis.

October 1 2021. Hence all vehicles will have to pay the same amount as mileage tax regardless. The California legislature passed a bill extending a road usage charge pilot program.

Democrats say they need a Mileage Tax because cars have become more fuel efficient and California is also advancing a new mandate to require more electric vehicles be. 10 They both increased. A mileage tax would not be calculated on a per gallon basis.

California to begin plan for sweeping BAN on new gasoline car sales TOMORROW. 0625 per mile from July 1 to December 31 2022. Since 2015 the program allows the state to study a road.

The bill would require. Now the California legislature is looking at a voluntary program that would eliminate the states gas tax which currently stands at 529-cents per gallon - second highest in the. The bill would require that participants in the program be charged a mileage-based fee as specified and receive a credit or a refund for fuel taxes or electric vehicle fees as specified.

Adjusted Annual Property Tax Bill Los Angeles County Property Tax Portal

Sandag S Proposed Road Charge Would Piggyback On California S Plans For A Per Mile Driver Fee The San Diego Union Tribune

Vehicle Mileage Tax Could Be On The Table In Infrastructure Talks Buttigieg Says

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Secured Property Taxes Treasurer Tax Collector

San Diego Driving Tax Locals Torn Over Per Mile Road Usage Tax Discussed By Sandag

Politifact Biden Infrastructure Plan Wouldn T Establish A Per Mile Driving Tax Nbc 6 South Florida

Local Mayors Get Cold Feet On Plans For Mileage Tax On San Diego Drivers By 2030 Kpbs Public Media

California S Road Usage Charge Pilot Program Stirs Controversy The Coast News Group

A Primer On Vehicle Miles Traveled Taxation Concepts California Globe

Everything You Need To Know About Vehicle Mileage Tax Metromile

What Are The Mileage Deduction Rules H R Block

Sandag Plan Board Of Directors Approves 160 Billion Transportation Plan Cuts Out Mileage Tax

Mile Marker A Caltrans Performance Report Spring 2020 Caltrans

County City Leaders Push Back Against Proposed Mileage Tax

Paying By The Mile For California Roads Infrastructure Capitol Weekly Capitol Weekly Capitol Weekly The Newspaper Of California State Government And Politics